Field Service Management Market Size & Trends:

The global field service management market size was valued at USD 5.2 billion in 2021 and is projected to reach USD 29.9 billion by 2031, growing at a CAGR of 19.2% from 2022 to 2031.

The factors that drive the growth of the field service management industry include rise need to keep a track of activities taking place in the field, increase in demand for mobility for getting real-time visibility, rise in adoption of automation & digitalization in the field services industry, increase in adoption of IoT driving the adoption of cloud-based FSM solution and integration of AI, AR and VR in field services sector. However, scarcity of skilled workforce to operate on FSM & data security concerns and sticking to manual methods are expected to hamper the field service management market growth during the forecast period.

Conversely, the field service management market research highlights that the industry is anticipated to witness significant growth, offering numerous opportunities for new players in the market. Rise in adoption of artificial intelligence (AI) and machine learning (ML) offer significant opportunities for predictive maintenance, route optimization, and enhanced decision-making. By analyzing historical data, AI can predict equipment failures, allowing technicians to address issues proactively. This helps businesses reduce costs and improve service delivery by shifting from reactive to preventive maintenance. In addition, the increase in use of augmented reality (AR) and virtual reality (VR) provides remote assistance. Field technicians can use AR glasses for step-by-step repair instructions or real-time remote support, enhancing training and troubleshooting. This reduces service times and improves accuracy in complex scenarios.

For instance, on January 23, 2025, Totalmobile launched a new Strategic Alliances and Partner Program to foster collaboration and innovation across industries. The global initiative aims to address key challenges faced by (FSM) field service providers, focusing on boosting efficiency, enhancing sustainability, reducing costs, and adapting to workforce changes by partnering with organizations committed to improving mobile workers' productivity.

Furthermore, the surge in the integration of field service management solutions with enterprise resource planning (ERP) and customer relationship management (CRM) systems enables streamline information flow across departments. This integration ensures technicians have access to the latest customer and product data, resulting in better service, more efficient billing, and enhanced customer relationships. These factors are expected to offer remunerative opportunities for the growth of the market.

For instance, on December 03, 2024, Workiz launched an innovative AI service called Genius Answering, designed to transform field service management. This service, part of the Workiz Genius suite, features an AI dispatcher named Jessica, who handles calls, books jobs 24/7, and integrates seamlessly with existing FSM processes. Genius Answering aims to reduce missed calls, increase revenue, and enhance customer satisfaction by providing continuous availability and personalized customer engagement.

Moreover, with an upsurge in the emphasis on sustainability, field service management solutions help companies manage energy consumption, reduce waste, and optimize resource usage during field operations. This aligns with environmental goals and meets regulatory requirements, appealing to environmentally conscious customers. In addition, field service management solutions are increasingly being tailored to meet the needs of small and medium-sized businesses (SMBs) that previously couldn't afford complex enterprise solutions, offering affordable, scalable, and customizable, enabling SMBs to enhance their field service operations and compete effectively with larger organizations. As FSM solutions become more digital, strong cybersecurity is essential. Companies that provide secure FSM platforms can protect customer data and prevent cyberattacks, ensuring privacy and avoiding disruptions. These factors are expected to offer lucrative field service management market opportunities for market growth.

For instance, on June 12, 2023, Solarvista launched the world's first '2-in-1' Field Service Management (FSM) system combined with a no-code application platform. This innovative solution allows companies to create customized applications quickly and efficiently, integrating both ready-made FSM features and customizable no-code capabilities. This hybrid approach aims to enhance business agility, streamline field operations, and improve overall service delivery.

Market Trends Insights:

The field service management market report highlights that the marke is expected to witness several noteworthy trends in the market. One of the significant trends is the increase in the adoption of IoT and smart devices is transforming Field Service Management (FSM) by providing real-time data from field equipment. IoT sensors enable technicians to monitor performance, predict maintenance needs, and diagnose issues remotely, reducing downtime, improving service call efficiency, and enhancing customer satisfaction.

In addition, there is growing trend toward the rise of mobile devices and remote working, leading to surge in the demand for mobile solutions that enable field service technicians to access work orders, service histories, and customer data from their phones or tablets. This enhances workforce efficiency and productivity, reduces administrative tasks, and allows for faster response times. Furthermore, the shift in preferences toward the adoption of cloud-based field service management solutions offer a centralized platform for managing operations such as scheduling, dispatching, billing, and inventory management, enabling real-time updates and team collaboration. Companies benefit from lower upfront costs, scalability, and easy access to data from anywhere, which is especially advantageous for global operations. This is expected to drive market growth in the upcoming years.

For instance, on July 8, 2024, KCS acquired Klipboard, a leading cloud-based field service management platform. Klipboard helps businesses streamline operations, improve customer experience, and manage jobs across various industries, including HVAC, plumbing, and healthcare. This acquisition enhances KCS's existing business management software, bridging field operations and back-office processes to boost efficiency and service delivery. Klipboard’s CEO, Draven McConville, expressed excitement about leveraging KCS’s resources to accelerate product development and provide greater value to customers.

Another notable trend in the market is the advanced scheduling and dispatch software that automate task assignments for field technicians, optimizing routes and schedules. This reduces manual processes and increases efficiency. Businesses can lower costs, improve service accuracy, and enhance customer satisfaction by ensuring the right technician is dispatched at the right time. In addition, there is growing trend toward customer self-service portals empowering users to schedule service appointments, track progress, and troubleshoot minor issues independently, without needing to contact customer support. This reduces the need for direct intervention from field service teams and enhances the overall customer experience by providing greater control and transparency. Furthermore, there is growing popularity of subscription-based models across various industries, field service managemen providers offer service contracts or subscription-based solutions that ensure a consistent, predictable revenue stream while providing clients with regular, ongoing support. This model fosters continuous customer engagement and builds long-term relationships. This is expected to accelerate market growth in the upcoming years.

For instance, on July 15, 2024, HERE Technologies launched a new integration to enhance SAP Field Service Management by incorporating HERE's high-performance and scalable routing capabilities. This integration aims to optimize job assignments and fleet tour planning, reducing travel time, optimizing schedules, and utilizing resources more efficiently. The key benefits include enhanced operational efficiency, cost reductions, more sustainable operations, and improved customer experiences.

Field service normally means dispatching employees or contractors to specific locations to install, repair, or maintain systems or equipment. Field service management (FSM) is a system designed to keep track of different components of field operations. These components usually include inventory management, scheduling, vehicle tracking, dispatching, invoicing, billing, customer portals, and others. Field service management industry seeks to improve deliverability and productivity of field service teams. Some of the key advantages of FSM include accessibility to customer information from any location, decrease in operational overheads and fuel expenses, management of mobile workforce, improvement of productivity, and enhancement of customer satisfaction.

Type Insights:

The field service management market is segmented by various services and solutions that address the diverse needs of businesses in managing on-site operations, essential for the success of FSM solutions, influencing service delivery, maintenance, and customer satisfaction.

Software Solutions: Software platforms are essential to FSM, enabling workflow automation, asset tracking, and optimized scheduling and dispatching. These solutions range from basic tools to advanced AI-powered platforms with predictive analytics and real-time data insights. SaaS is the dominant model due to its scalability, cost-efficiency, and ease of integration.

Hardware Solutions: Hardware solutions enhance field service capabilities with devices like ruggedized tablets, wearables, and IoT sensors. These tools enable efficient monitoring, repair, and maintenance. IoT-based solutions, in particular, provide real-time equipment health data, facilitating predictive maintenance, reducing downtime, and preventing costly failures.

Managed Services: Managed services offer end-to-end field service support, including technician staffing, equipment maintenance, and IT infrastructure management. This allows businesses to focus on core operations while experts handle their field service needs.

Integration Services: Integration services ensure FSM systems seamlessly connect with CRM, ERP, and supply chain management software, enhancing workflow coordination, customer insights, and overall operational efficiency.

For instance, on November 4, 2024, Simpro, a global leader in field service management software, accelerated its business momentum by driving innovation across the field service industry. The company has hosted successful global user events and expanded its executive leadership, demonstrating its commitment to empowering trade and field services businesses worldwide. These developments highlight Simpro's focus on enhancing productivity and efficiency for its customers.

Segment Review:

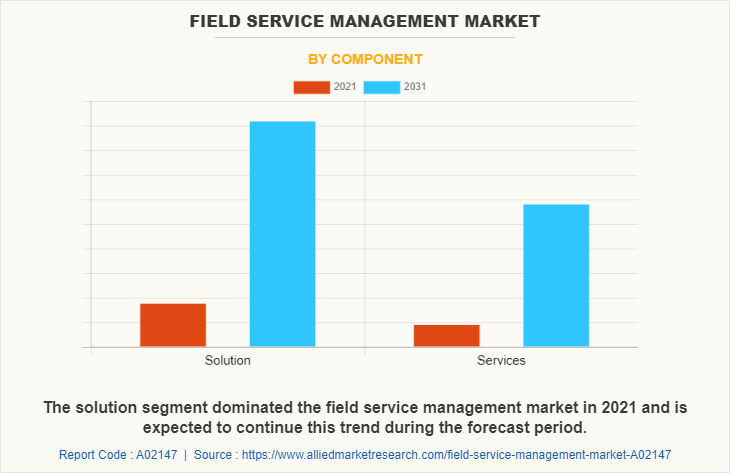

The FSM industry is segmented on the basis of component, deployment, organization size, industry vertical, and region. By component, the market is divided into solution and services. The solution segment is sub-divided into segments such as schedule, dispatch, & route optimization, customer management, work order management, inventory management, service contract management, reporting & analytics, and others. The services segment is further categorized into implementation & integration, training & support, consultancy services. On the basis of deployment, the market is classified into on-premise and cloud.

According to organization size market is classified into large enterprises and small & medium sized enterprises (SMEs). As per industry verticals, market is divided across IT & telecom, healthcare & life sciences, manufacturing, BFSI, transportation & logistics, energy & utilities, construction and others. Based on region, the global field service management fsm market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of component, the solution segment dominated the overall field service management market analysis in 2021 and is expected to continue this trend during the forecast period. This is attributed to an increase in adoption of field service management market growth solutions among enterprises to gain strategic as well as competitive advantage and strong customer retention over their competitors.

In addition, it helps industry vertical to engage workers on field work easily and sustain them for long time, which drives the growth of the FSM industry. However, the service segment is expected to witness highest growth, as service segment of field service management market ensures effective coordination between software provider companies and users of field service management software by providing services such as implementation, training, consulting services, and managed services.

The adoption of these services speeds up the customer satisfaction of various industrial verticals such as BFSI, IT & telecommunication, and healthcare, which maximizes the value of existing customer by optimizing their needs and minimizes the cost of operation. This further fuel the adoption of services that are needed to handle the software properly.

By region, North America garnered the largest share in 2021, and is expected to continue this trend during the forecast period. Factors, such as, increase in awareness about advanced field management solution, cloud technology adoption, and significant adoption of mobility in the field service industry drive the growth of the FSM market in North America. However, Asia-Pacific is expected to exhibit highest growth during the forecast period, owing to strong economic growth along with the ongoing development in field service and inventory management, which drives organizations to invest heavily in field service management fsm market to sustain growth and improve productivity.

In addition, factors such as major shift toward digital transformation, cloud deployment & technological advancement among small & medium businesses, and continuously ongoing modernization in work force management strategy in emerging economies notably contribute toward the market growth.

Competitive Analysis:

The key players operating in the field service management market include MICROSOFT CORPORATION, OVERIT, SAP SE, SALESFORCE.COM, INC, INFOR, PRAXEDO, SERVICEMAX, COMARCH SA, ORACLE CORPORATION, IFS AB. These key players have adopted various strategies, such as product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations, to increase their market penetration and strengthen their foothold in the field service management industry.

Top Impacting Factors:

Increase in Adoption of Automation & Digitalization in the Industry:

Field service providers are shifting from traditional way operations to modernizing their business processes. Field service companies are increasingly adopting automation & digitalization into field service operations due to changes in customer demands. Automation assists employees to improve their productivity for serving their clienteles in a better way. It enables to adapt to the changes in needs of a field operator throughout the day and eradicates unproductive operations & saves time. It helps immediate access to inventory to the employees, which makes it easy for them to serve the requirements of the customer.

Thus, companies are realizing the need for automating field service management solutions, which drives the demand for the market. FSM market vendors are actively trying to enhance their offerings by using advanced technologies such as AI. For instance, in November 2018, the global automation software provider, ICONICS launched the CFSWorX™ app, which empowers field service workers and maintenance personnel to move past the legacy break/fix model towards more proactive facilities and equipment management. The software can be easily integrated into an organization’s existing Enterprise Resource Planning (ERP) and/or Customer Relationship Management (CRM) systems, utilizing existing contact information, schedules, and field workers’ catalogued skill sets. Such enhancement drives the field service management market demand.

Rise in Demand for Mobility for Getting Real-time Visibility:

Before the advent of smart phones and tablets, field services business could not be operated remotely. This is now turned into reality due to rise in usage of smart phones and tablets amongst the end users. The real-time monitoring of the field service technicians helps in the timely dispatch of the nearest technician to resolve an issue.

In addition, it also provides field technicians with the essential customer & case data and step-by-step guidance required to solve the client’s problem and improve first-time fix rates. Technicians can remotely reboot a machine or upload new software through mobility powered field service management solutions instead of going to the site. Equipping technicians with the correct information through mobile application is expected to boost revenue by field-based sales. Customers can track the technician’s movement by real-time visibility into the mobile application and be assured of the help approaching in promised time. Hence, the adoption of mobility field service solutions facilitates service organizations to get better control on the field operations, make better business decisions, and deliver fast services to their customers.

Recent Partnership in the Market:

On February 26, 2025, Freshworks partnered with Unisys to transform IT Service Management (ITSM) for mid-market and enterprise companies. This collaboration aims to leverage Freshworks' modern ITSM solutions, including Freshservice and Device42, and Unisys' global reach and expertise in ITSM and field services.

Key Benefits for Stakeholders

- The study provides an in-depth analysis of the field service management market share along with current field service management market trends and future estimations to elucidate the imminent investment pockets.

- Information about key drivers, restraints, and opportunities and their impact analysis on the field service management market size is provided.

- The Porter’s five forces analysis illustrates potency of buyers and suppliers operating in the accounting software market.

- The quantitative analysis of the field service management market share from 2022 to 2031 is provided to determine the market potential.

Field Service Management Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 29.9 billion |

| Growth Rate | CAGR of 19.2% |

| Forecast period | 2021 - 2031 |

| Report Pages | 398 |

| By Component |

|

| By Deployment Model |

|

| By Enterprise Size |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | MICROSOFT CORPORATION, INFOR, OVERIT, COMARCH SA, ORACLE CORPORATION, SAP SE, SERVICEMAX, SALESFORCE.COM, INC, IFS AB, PRAXEDO |

Analyst Review

According to CXOs of the leading companies, the global field service management market provides lucrative opportunities to market players. Increase in scope of applications of FSM, such as scheduling & dispatching, route optimization, work order management, inventory management, and service contract management, have contributed toward the field service management market growth. Prominent players in the market have developed and launched new technologies, such as AI based FSM software enabling automated scheduling, dispatching, routing to cater to a wide field technicians base in various locations, usage of AR goggles for assessing the equipment failure & predictive maintenance.

The manufacturing segment has a predominant share in the global field service management market and is expected to maintain this trend during the forecast period. However, the demand for field service management solutions is expected to significantly increase across sectors such as transportation & logistics, healthcare, real estate, energy & utilities, and retail.

Moreover, increase in technological advancements such as driverless cars, 3D mapping, and other supporting software components is expected to supplement the growth of the FSM services market. Market players have adopted acquisition, partnership, and product launch strategies to improve their product portfolio and expand their geographical outreach.

For instance, in August 2022, MiX Telematics, a leading global SaaS provider of connected fleet management solutions signed a definitive agreement to acquire Trimble's Field Service Management's (FSM) business. Through this combination, MiX and Trimble Field Service Management teams will work very closely together to ensure a seamless transition.

In addition, this combination adds significant scale to North American telematics subscriber base while diversifying that business into additional industry verticals. North America is a strategic priority for MiX and well positioned to pursue M&A opportunities to propel regional organic growth investment.

Moreover, the proliferation of connected devices such as smartphones and advent of Internet of Things (IoT) is expected to create increasing demand for mobile field service management solutions, which in turn is expected to boost the growth of the field service management market. Furthermore, adoption of IoT along with AI in field services empower field service organizations to avoid equipment downtime and offer predictive maintenance. This is again expected to garner significant opportunities for market growth.

The global field service management market size was valued at USD 5.2 billion in 2021, and is projected to reach USD 29.9 billion by 2031

The global field service management market is projected to grow at a compound annual growth rate of 19.2% from 2021-2031 to reach USD 29.9 billion by 2031

The North America is the largest market for field service management market.

The key players profiled in the reports includes Oracle Corporation, Microsoft, IFS AB, Salesforce.com Inc., ServiceMax, OverIT, Comarch SA, Infor, Praxedo, and SAP SE

Factor such as increase in need for automation in field service operations, rise in need for real time visibility in field service management, proliferation of mobile devices, shifting preference toward cloud-technology, and need to keep track of all the activities & resources associated with field services are some of the key factors that drive the growth of the global field service management market.

Loading Table Of Content...